The global telecom industry is growing rapidly with an estimated market size valued at USD 1,657.7 billion. The US alone had 340 million cellular subscriptions at the end of 2018, which accounted for 1.36 billion customer care interactions, assuming that an average subscriber connects with a support operator four times per year. But the number is poised to reach a whopping 1.765 billion by 2023, according to iGR forecasts.

Even as the growth figures are promising for the industry, it faces a host of challenges related to customer experience, authentication, and fraud prevention. These include:

- Ensuring a customer’s identity while making the interaction seamless and preventing undue intrusion

- Protecting the subscribers and consolidating trust

- Providing a consistent customer experience across all channels

- Reducing costs and handling time for customer support agents

Safeguarding consumer data is one of the biggest concerns because the industry struggles with prevalent frauds that put consumer information at risk. Telecom organisations need to go the extra mile with consumer protection, which is only possible if they have a reliable method for identity verification. At the same time, this method should not disrupt their experience with the brands.

Thankfully, biometric authentication emerges as a winner on both fronts. It enables reliable surveillance without compromising the customer experience. Before digging deeper into the solution, it becomes vital to understand the fraud and risk landscape of the industry.

Let us explain how these risks operate and how biometrics can address them effectively.

The prevailing risks of cons in telcos

When a customer is connected with the customer care service, the agents confirm the caller identity by asking a series of questions. Further, they may do more with steps like follow-up questions, sending an OTP via SMS, or two-factor authentication.

Even as telcos do their bit to bolster their security capabilities, there are still chances of frauds as fraudsters are coming up with clever ways to create fake accounts or take over existing ones. There are constant attempts to steal customer accounts and personal information, which can damage client relationships and the reputation of the business.

It becomes vital for telcos to address the risks and protect their brands, which is possible only with the implementation of stringent customer authentication methods.

As they look for such measures, customer experience should be a priority because organisations cannot sacrifice CX for the sake of security. Measures such as security question answers, OTP services, and gathering personal information may provide security but often interferes with customer experiences.

Customers tend to get frustrated with such actions, and there are chances that telcos will lose them for good after such high-effort service interactions.

Increasing security does not work in the favour of the provider because there is a corresponding increase in the customer churn rate. If you are looking to find the perfect balance between the two, you need to find a method of authentication that keeps the CX totally frictionless.

Customer experience is the top priority

The telecom industry is a highly competitive one, and a sub-optimal experience is enough to drive away your customer for good. Subscribers even switch mobile operators just because they face a billing or customer service issue.

Needless to say, you have to exceed customer expectations every time customers connect for online interactions or support calls.

For businesses, CX has to be the top priority in this vertical as your subscribers wouldn’t settle for anything but the best. It is crucial to strengthen, shorten, and streamline the authentication processes so that you can reduce the subscriber churn. It can make your call centres more economical, which will go a long way to put your business on a growth trajectory.

Biometrics: The solution that gets you the best of both worlds

Achieving a balance between fraud prevention and customer experience may seem like an impossible feat, but it isn’t. Biometric authentication is coming as a solution that gets you the best of both worlds.

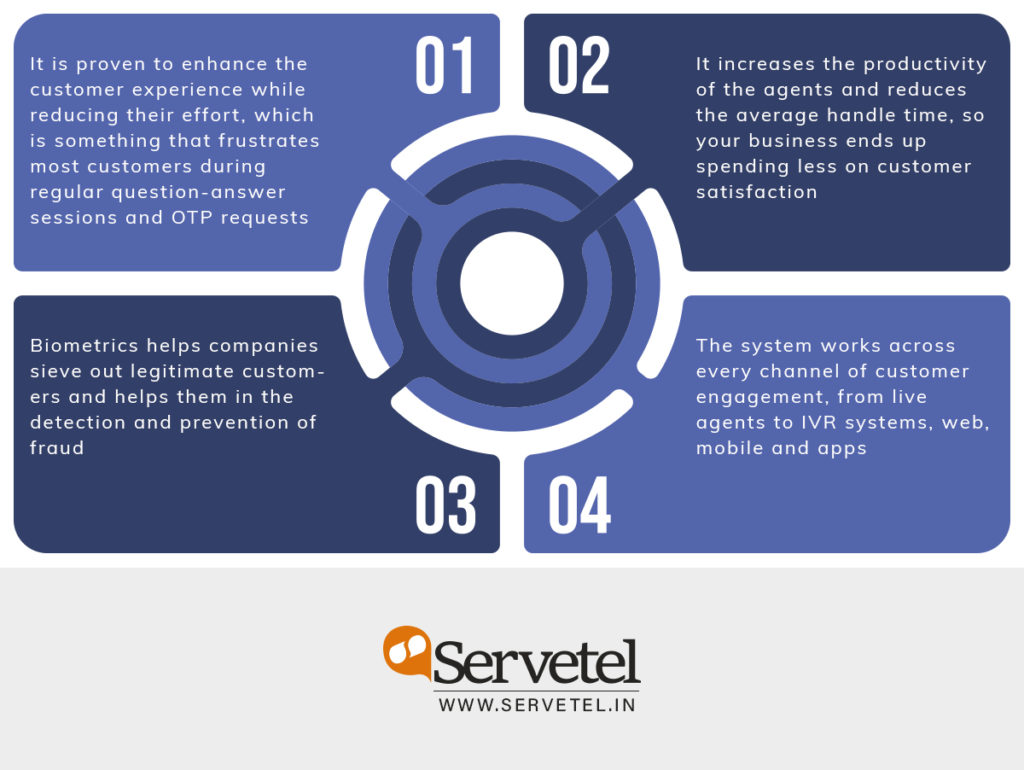

Here are some reasons why it is emerging as a reliable measure to win customer trust while ensuring that your business and customers are covered from fraudulent activities.

Through biometrics, telcos can authenticate users by using their voice, behaviour, and even language, a novel concept that uses conversational biometrics. Voice biometric solutions leverage a valid voice print and match it to the voice of the caller.

Behavioural biometrics assesses the behaviour of the user, such as how they type, pause, or use the mouse. They create a user profile and compare the actions with the profile every time the user accesses the mobile and website applications subsequently.

Device-based biometric solutions use facial or fingerprint biometrics for accessing a mobile device. These are not used for interacting with customer support though; rather they are confined to access only. The verification processes are accelerated as it takes only a few seconds, while the accuracy is impeccable.

The Takeaway

Biometrics authentication is the smartest investment for a modern telco business that wants protection against frauds without compromising the customer experience. It ensures speed, accuracy, and seamlessness so that your business will never go wrong on the count of security and CX. It’s a one-stop solution that will establish trust and reputation for your brand. The companies dealing with consumer data shouldn’t think twice about implementing biometric authentication.

To know more dial 1800-120-4132 and talk to our experts.